I am filling out my taxes on FreeTaxUSA and I needed some help regarding creating Form 8606. I had asked for advice on my situation earlier; if anyone is curious to read, the post is: "viewtopic.php?p=7699101#p7699101"

To summarize my situation:

In October 2023, I deposited $6500 of after-tax money into a Traditional IRA.

In January 2024, I did a Roth conversion of the entire Traditional IRA balance.

Thus, I need to fill out Form 8606 for the 2023 tax year for the nondeductible contribution to my Traditional IRA and then fill out Form 8606 for the 2024 tax year for the Roth Conversion.

I have manually filled out the Form 8606 for each year as the following listed below:

For 2023, Form 8606 comes out as follows:

Line 1: 6500

Line 2: 0

Line 3: 6500

Line 4: Blank

Line 5: Blank

Lines 6: Blank

Lines 7: Blank

Line 8: Blank

Line 9: Blank

Line 10: Blank

Line 11: Blank

Line 12: Blank

Line 13: Blank

Line 14: 6500

Line 15a: 0

Line 15b:0

Line 15c: 0

Line 16: Blank

Line 17: Blank

Line 18: Blank

Line 19: Blank

Line 20: Blank

Line 21: Blank

Line 22: Blank

Line 23: Blank

Line 24: Blank

Line 25a: Blank

Line 25b: Blank

Line 25c: Blank

For 2024, Form 8606 comes out as follow:

Line 1: 0

Line 2: 6500

Line 3: 6500

Line 4: 0

Line 5: 6500

Lines 6: 0

Lines 7: 0

Line 8: 12183.72

Line 9: 12183.72

Line 10: 0.5335

Line 11: 6500

Line 12: 0

Line 13: 6500

Line 14: 0

Line 15a: 0

Line 15b:0

Line 15c: 0

Line 16: 12183.72

Line 17: 6500

Line 18: 5683.72

Line 19: Blank

Line 20: Blank

Line 21: Blank

Line 22: Blank

Line 23: Blank

Line 24: Blank

Line 25a: Blank

Line 25b: Blank

Line 25c: Blank

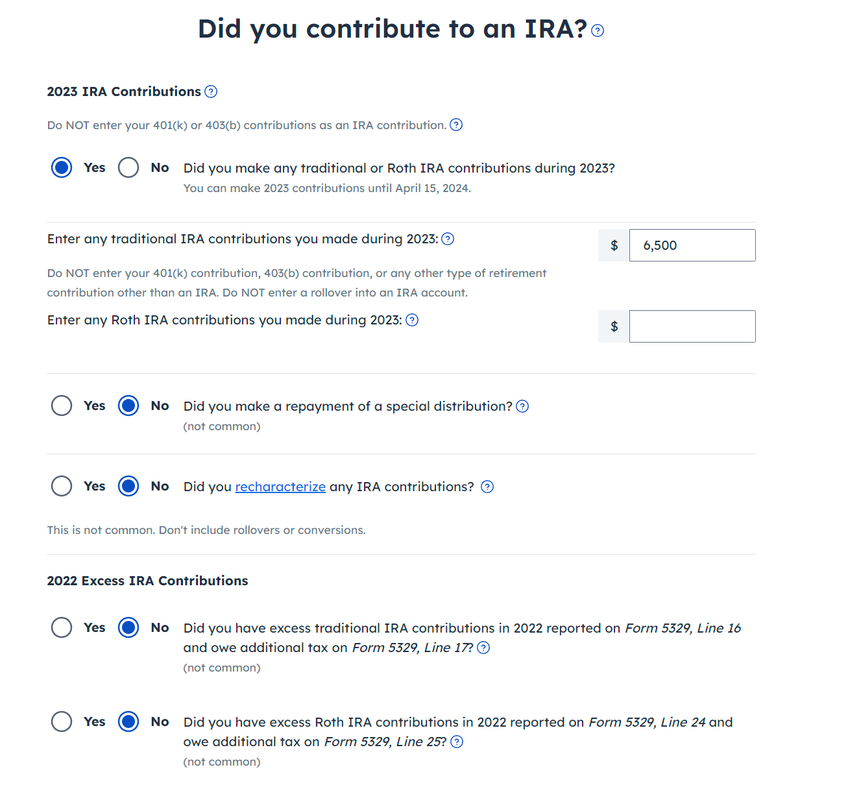

My question is how can I generate Form 8606 with the following info I listed for 2023? I filled out the IRA Contributions section as follows in the picture below, and all that is generating is an "IRA Deduction Worksheet—Schedule 1 Line 20". I don't see any place that generated the Form 8606. If it matters, my income for 2023 was $64,695, so it seems that FreeTaxUSA is forcing me to treat my TIRA contribution as deductible, which I do not want.

![Image]()

To summarize my situation:

In October 2023, I deposited $6500 of after-tax money into a Traditional IRA.

In January 2024, I did a Roth conversion of the entire Traditional IRA balance.

Thus, I need to fill out Form 8606 for the 2023 tax year for the nondeductible contribution to my Traditional IRA and then fill out Form 8606 for the 2024 tax year for the Roth Conversion.

I have manually filled out the Form 8606 for each year as the following listed below:

For 2023, Form 8606 comes out as follows:

Line 1: 6500

Line 2: 0

Line 3: 6500

Line 4: Blank

Line 5: Blank

Lines 6: Blank

Lines 7: Blank

Line 8: Blank

Line 9: Blank

Line 10: Blank

Line 11: Blank

Line 12: Blank

Line 13: Blank

Line 14: 6500

Line 15a: 0

Line 15b:0

Line 15c: 0

Line 16: Blank

Line 17: Blank

Line 18: Blank

Line 19: Blank

Line 20: Blank

Line 21: Blank

Line 22: Blank

Line 23: Blank

Line 24: Blank

Line 25a: Blank

Line 25b: Blank

Line 25c: Blank

For 2024, Form 8606 comes out as follow:

Line 1: 0

Line 2: 6500

Line 3: 6500

Line 4: 0

Line 5: 6500

Lines 6: 0

Lines 7: 0

Line 8: 12183.72

Line 9: 12183.72

Line 10: 0.5335

Line 11: 6500

Line 12: 0

Line 13: 6500

Line 14: 0

Line 15a: 0

Line 15b:0

Line 15c: 0

Line 16: 12183.72

Line 17: 6500

Line 18: 5683.72

Line 19: Blank

Line 20: Blank

Line 21: Blank

Line 22: Blank

Line 23: Blank

Line 24: Blank

Line 25a: Blank

Line 25b: Blank

Line 25c: Blank

My question is how can I generate Form 8606 with the following info I listed for 2023? I filled out the IRA Contributions section as follows in the picture below, and all that is generating is an "IRA Deduction Worksheet—Schedule 1 Line 20". I don't see any place that generated the Form 8606. If it matters, my income for 2023 was $64,695, so it seems that FreeTaxUSA is forcing me to treat my TIRA contribution as deductible, which I do not want.

Statistics: Posted by Young_Investor — Mon Feb 19, 2024 10:24 pm — Replies 7 — Views 393