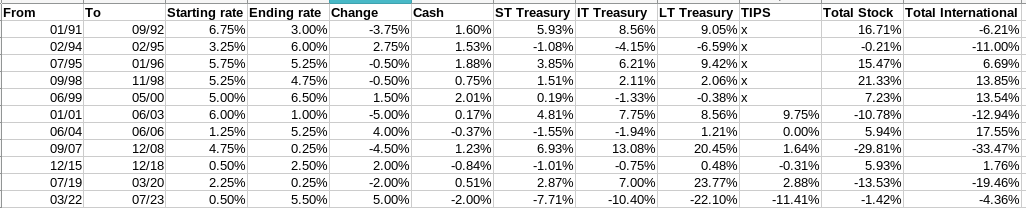

I saw this article recently and decided to plug in the time period into portfolio Visualizer. I apologize that this is an image, but getting a table to work on this forum is quite hard. Note that I used intermediate treasury instead of Total Bond market because the history doesn't go far enough LT Treasury is pretty close to Total Bond most of the time. TIPS has x because portfolio Visualizer doesn't have data before 2001. All returns are inflation adjusted.

Image may be NSFW.

Clik here to view.

I think the table doesn't show much useful information since it's over short periods of time, but I thought it may give people a different perspective than just 2022 rate hike by showing what happened in the previous hike and lower.

The following are just my observation. It doesn't actually contain info that people don't already know, but I thought I should state it any way.

Image may be NSFW.

Clik here to view.

I think the table doesn't show much useful information since it's over short periods of time, but I thought it may give people a different perspective than just 2022 rate hike by showing what happened in the previous hike and lower.

The following are just my observation. It doesn't actually contain info that people don't already know, but I thought I should state it any way.

- Bond funds are definitely not riskless. Most Bogleheads member know this but I have seen post where people thought they were.

- When interest rate is raised, it decreases the value of the bond based on their duration and vice versa. However, there may be some anomaly. For example LT Treasury had a higher return than intermediate from 2015-2018.

- When interest rate is raised, stock and bonds often fall together. Lowering the rate is often a boost to the stock market. This is not always the case.

- TIPS are also affect by interest rate risk. I think they are not a good protection against inflation short term. Ibonds are probably better.

- Cash is better than TIPS for short term inflation but only by losing less money.

- In 2007-2008, the Fed apparently lower rates by 4.5% over a period of a bit over a year, this would be a white mirror version of the 2022 to 2023 rate hike. What goes up will also come down in the same manner. Too bad we can't really predict rate hikes.

Statistics: Posted by gavinsiu — Wed Dec 20, 2023 8:25 am — Replies 0 — Views 152