Hi folks,

We are planning to retire in 3 years. Wife is a public school teacher in CA and will get a pension, but no SS. Husband will get SS.

Here is some background:

![Image]()

We are planning to retire in 3 years. Wife is a public school teacher in CA and will get a pension, but no SS. Husband will get SS.

Here is some background:

- Ages: Wife 52, Husband 49

- Ages (at planned retirement in 2027): Wife 55, Husband 52

- Current Portfolio size: $3MM (note that we expect close to $800k added to this portfolio when we sell our current home in 3 years. Retirement home has already been purchased). Rough breakdown of the resulting $3.8MM will be $1.6MM taxable, $1.7MM tax deferred and $0.5MM Roth.

- Expenses in retirement: $200K (this is very generous and includes over $70k in discretionary spending that can be cut down)

- Portfolio withdrawals

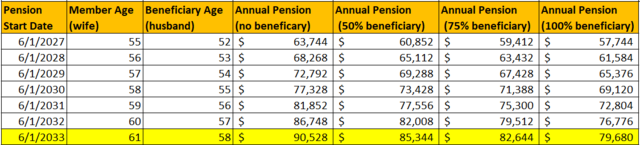

- DW's pension (see details below) - $90k

- DH's SS (collected at age 70) - $48k

- "Annual Pension (no beneficiary)" means DW will get this pension as long as she lives. If she dies before DH, he gets nothing.

- Annual Pension (xx% beneficiary) means DW will get this pension as long as she lives. If she dies before DH, he gets xx% of this amount. If he dies before her, she gets the full "Annual Pension (no beneficiary)" amount.

- There is no increase in pension beyond her age 61.

- Is it financially a good move to wait until she turns 61 to get the maximum pension in this case? This will mean the first 6 years of our retirement will be entirely supported by our retirement portfolio.

- They are both in good health but there is a greater longevity on her side of the family. Should we forego the beneficiary options and just go for the maximum pension where he gets nothing if she passes before him?

- Any other things we should consider?

Statistics: Posted by lifebeckonss — Wed Jul 24, 2024 8:54 pm — Replies 2 — Views 421