Of course you can do better than Total Bond. But at what cost, in terms of volatility? And by how much?

Material adduced in this thread will be largely in accordance with a point that nisiprius has pressed: you can fiddle with the components of your bond allocation all you want, but it won’t make a rodent’s rear-end difference to your overall portfolio return, in comparison to the difference it makes to have this much more allocated to stocks, and this much less allocated to bonds of any kind.

Our first pair of propositions:

Stock-bond allocation: huge.

Within-bond allocation: splitting hairs.

That’s the theory, anyway, and on the face of it, a good theory: not least, because it’s falsifiable using finite empirical data. This thread makes the attempt, putting BND in the dock and pressing the case.

Alternatives to Total Bond are out there, and if you pick the exact right time interval, these alternatives out-performed BND. I’ll show you.

The initial time interval used here is end-1991 to end-2023, thirty-two years. I hope it goes without saying, but I’ll say it anyway: what a meagre, pitifully abbreviated back test!

Might this post be wasting your time? Then stop reading immediately. Please don’t waste any more of your time by writing a post explaining why the thread is a waste of your time (a peculiar habit much in vogue here on the forum).

Where was I? Uh, yes, that it is meaningless to show out- or under-performance of Total Bond over mere decades. Strictly speaking.

Whoo. Good to get that off my chest. Now that full disclosure has been made, let’s proceed to the charts.

*One other disclosure: I use the ETF labels (BND, VGIT, etc.) because they are more familiar now; but most of the data pertains to their mutual fund equivalents, with their less familiar tickers. FYI. The data come from Simba.

Test #1: Intermediate Treasuries

To begin, let’s impose another restriction: only data from mutual funds, the ones we ordinary mortals can purchase, count. Hence the 1991 start date: from there, we have VGIT and its mutual fund predecessors available.

I start here because many would say that intermediate Treasuries represent the number one rival to Total Bond, because:

-same intermediate duration (Goldilocks principle)

-no credit risk

-likely lower correlation to stocks, because no corporate component, therefore a better diversifier.

-likely lower volatility, because … oops, brain toot: trying to remember why a handful of Treasury issues would have a lower standard deviation than the 10,000 highly diverse bonds in Total Bond. Uh, … because safer? Guess this one is an empirical question.

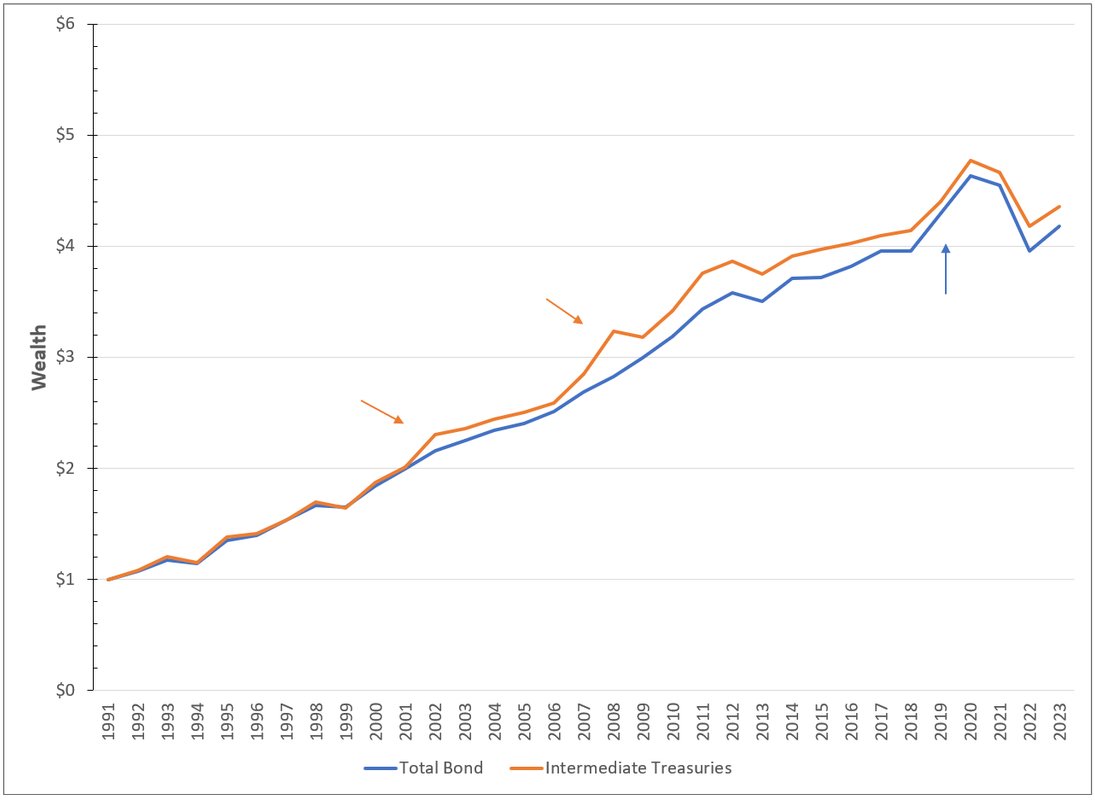

Here’s the value of $10,000 invested in one or the other mutual fund since end-1991.

![Image]()

And the winner is … Intermediate Treasuries! You would have turned $10,000 into $43,560; Total Bond would have only produced $41,780.

I can see that you are underwhelmed. Let’s parse this trivial and uninteresting difference into something that might convey a shred of insight.

Note the two kick-ups that put VGIT into the lead: the Dot-com bust and the Great Financial Crisis. Inference: Treasuries are where you want to be when the brown smelly stuff hits the whirling blades.

Note the later point where VGIT almost forfeited the lead: 2020, after the Federal Reserve rode to the pandemic rescue, and bond prices soared in relief (Did I mention that BND has a somewhat higher duration than the IT fund?)

Which also explains why BND dropped further in the Great Bond Market Bust of 2022.

There is only one problem with this happy picture, you BND haters:

BND Standard Deviation = 5.34%

VGIT SD = 6.35%

Oops … too much volatility in the Treasury fund, due to those upside surges in 2000-02 and 2007-8. We don’t want a bond fund that soars just because stocks are plunging—right? Bonds are about damping volatility, not accentuating it.

Given the pitifully short time span and all the unique events that occurred, I have to call this first contest a draw.

Total Bond or VGIT—it depends on whether you are more of a returns-phile or a risk-phobe.

Total Bond versus Total TIPS

After intermediate Treasuries, the next most prominent rival to BND is probably a total TIPS fund like VAIPX.

-still an intermediate duration

-you give up the risk premium associated with corporate bonds, but gain the inflation protection provided by TIPS

-you have the comfort of owning 100% Treasuries

Unfortunately, the TIPS fund dates to only 2001, so now the back test goes from pitifully abbreviated to …agonizingly short? Silly in the extreme? Dauntingly inadequate?

Whatever, here is the chart

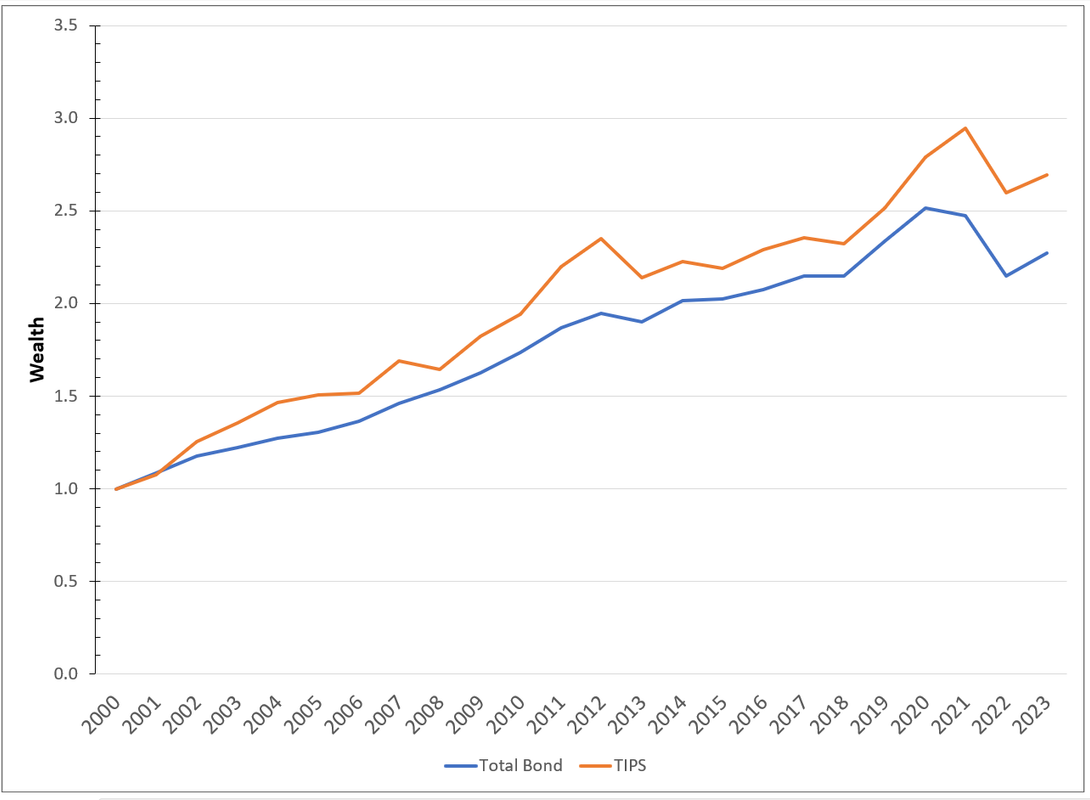

![Image]()

Score, TIPS! You got $26,960 instead of $22,710, about a fifth more wealth than had you put the $10,000 in BND, while taking less risk: i.e., no credit risk and no inflation risk.

Except, whoops, that last statement is false. Here are the standard deviations for that twenty-three-year period:

BND = 4.72%

VPIAX = 6.64%

Are you sure you could have withstood that extra volatility? Almost 200 bp more? Remember, you are a bond investor. You are repelled by volatility. It makes your stomach churn.

Preliminary conclusion: yes you can beat BND with other intermediate duration funds—but only by taking on extra risk, with risk defined as the theorists do, as standard deviation (volatility). Very tough to beat the diversification achieved by owning 10,000 bonds of all types, as opposed to a handful of Treasuries. Man, those suckers are volatile.

Objection, your honor!

Whoa, what do we know about TIPS in the early 2000s? They were still very new, and perhaps, not well understood (heck, reading the forum twenty years on reminds me that plenty of investors still do not feel confident in their understanding of TIPS—despite the mighty labors of #cruncher).

Because they were newfangled, TIPS offered very high real yields at first—4% more or less, which I never expect to see again in my lifetime.

Those yields came down over time … which is to say, TIPS rallied and rallied. Is it fair to compare them in this early phase to a mature product like BND?

Objection sustained.

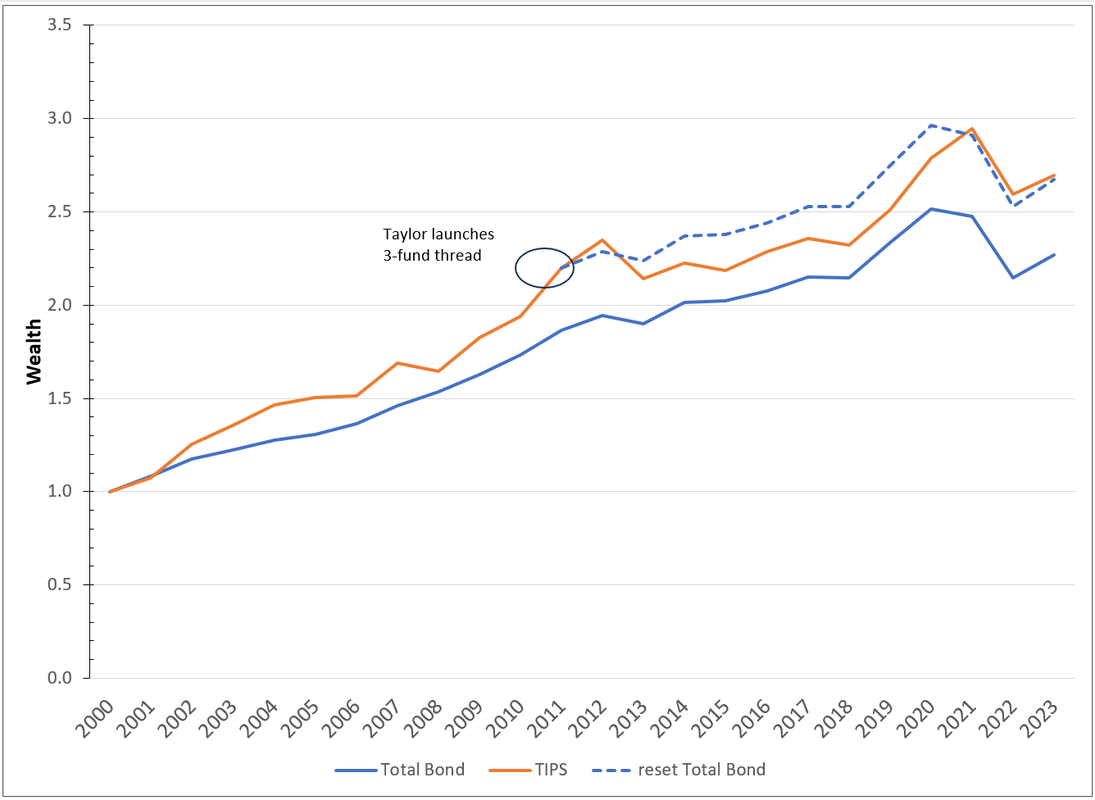

Here’s a reset of the BND line, from when Taylor first launched the 3-fund thread.

![Image]()

Move along folks, nothing to see here. Until that, ahem, unexpected inflation in 2021 and 2022, BND was crushing the TIPS fund.

Over this entire 144 month period, after TIPS had settled into their groove, the two intermediate duration bond funds performed about the same … except the TIPS fund was still more volatile, despite doing a tad better in the big down draft of 2022.

Gonna have to record this second comparison as a tie as well.

Next steps

Of course we could continue in this vein, comparing yet other bond funds; but that rather misses the point. The guiding theme of the thread is the hoary old nostrum beloved of the forum: “Take your risk on the equity side. You decide how much risk you can stand, and then you slot in an allocation to BND sufficient to dial back your stock risk to the desired level.”

For that, we need to look at portfolios that hold both stocks and bonds, and see what happens when we swap out BND for some other kind of bond fund.

Results will partly depend on a familiar metric not yet introduced.

Material adduced in this thread will be largely in accordance with a point that nisiprius has pressed: you can fiddle with the components of your bond allocation all you want, but it won’t make a rodent’s rear-end difference to your overall portfolio return, in comparison to the difference it makes to have this much more allocated to stocks, and this much less allocated to bonds of any kind.

Our first pair of propositions:

Stock-bond allocation: huge.

Within-bond allocation: splitting hairs.

That’s the theory, anyway, and on the face of it, a good theory: not least, because it’s falsifiable using finite empirical data. This thread makes the attempt, putting BND in the dock and pressing the case.

Alternatives to Total Bond are out there, and if you pick the exact right time interval, these alternatives out-performed BND. I’ll show you.

The initial time interval used here is end-1991 to end-2023, thirty-two years. I hope it goes without saying, but I’ll say it anyway: what a meagre, pitifully abbreviated back test!

Might this post be wasting your time? Then stop reading immediately. Please don’t waste any more of your time by writing a post explaining why the thread is a waste of your time (a peculiar habit much in vogue here on the forum).

Where was I? Uh, yes, that it is meaningless to show out- or under-performance of Total Bond over mere decades. Strictly speaking.

Whoo. Good to get that off my chest. Now that full disclosure has been made, let’s proceed to the charts.

*One other disclosure: I use the ETF labels (BND, VGIT, etc.) because they are more familiar now; but most of the data pertains to their mutual fund equivalents, with their less familiar tickers. FYI. The data come from Simba.

Test #1: Intermediate Treasuries

To begin, let’s impose another restriction: only data from mutual funds, the ones we ordinary mortals can purchase, count. Hence the 1991 start date: from there, we have VGIT and its mutual fund predecessors available.

I start here because many would say that intermediate Treasuries represent the number one rival to Total Bond, because:

-same intermediate duration (Goldilocks principle)

-no credit risk

-likely lower correlation to stocks, because no corporate component, therefore a better diversifier.

-likely lower volatility, because … oops, brain toot: trying to remember why a handful of Treasury issues would have a lower standard deviation than the 10,000 highly diverse bonds in Total Bond. Uh, … because safer? Guess this one is an empirical question.

Here’s the value of $10,000 invested in one or the other mutual fund since end-1991.

And the winner is … Intermediate Treasuries! You would have turned $10,000 into $43,560; Total Bond would have only produced $41,780.

I can see that you are underwhelmed. Let’s parse this trivial and uninteresting difference into something that might convey a shred of insight.

Note the two kick-ups that put VGIT into the lead: the Dot-com bust and the Great Financial Crisis. Inference: Treasuries are where you want to be when the brown smelly stuff hits the whirling blades.

Note the later point where VGIT almost forfeited the lead: 2020, after the Federal Reserve rode to the pandemic rescue, and bond prices soared in relief (Did I mention that BND has a somewhat higher duration than the IT fund?)

Which also explains why BND dropped further in the Great Bond Market Bust of 2022.

There is only one problem with this happy picture, you BND haters:

BND Standard Deviation = 5.34%

VGIT SD = 6.35%

Oops … too much volatility in the Treasury fund, due to those upside surges in 2000-02 and 2007-8. We don’t want a bond fund that soars just because stocks are plunging—right? Bonds are about damping volatility, not accentuating it.

Given the pitifully short time span and all the unique events that occurred, I have to call this first contest a draw.

Total Bond or VGIT—it depends on whether you are more of a returns-phile or a risk-phobe.

Total Bond versus Total TIPS

After intermediate Treasuries, the next most prominent rival to BND is probably a total TIPS fund like VAIPX.

-still an intermediate duration

-you give up the risk premium associated with corporate bonds, but gain the inflation protection provided by TIPS

-you have the comfort of owning 100% Treasuries

Unfortunately, the TIPS fund dates to only 2001, so now the back test goes from pitifully abbreviated to …agonizingly short? Silly in the extreme? Dauntingly inadequate?

Whatever, here is the chart

Score, TIPS! You got $26,960 instead of $22,710, about a fifth more wealth than had you put the $10,000 in BND, while taking less risk: i.e., no credit risk and no inflation risk.

Except, whoops, that last statement is false. Here are the standard deviations for that twenty-three-year period:

BND = 4.72%

VPIAX = 6.64%

Are you sure you could have withstood that extra volatility? Almost 200 bp more? Remember, you are a bond investor. You are repelled by volatility. It makes your stomach churn.

Preliminary conclusion: yes you can beat BND with other intermediate duration funds—but only by taking on extra risk, with risk defined as the theorists do, as standard deviation (volatility). Very tough to beat the diversification achieved by owning 10,000 bonds of all types, as opposed to a handful of Treasuries. Man, those suckers are volatile.

Objection, your honor!

Whoa, what do we know about TIPS in the early 2000s? They were still very new, and perhaps, not well understood (heck, reading the forum twenty years on reminds me that plenty of investors still do not feel confident in their understanding of TIPS—despite the mighty labors of #cruncher).

Because they were newfangled, TIPS offered very high real yields at first—4% more or less, which I never expect to see again in my lifetime.

Those yields came down over time … which is to say, TIPS rallied and rallied. Is it fair to compare them in this early phase to a mature product like BND?

Objection sustained.

Here’s a reset of the BND line, from when Taylor first launched the 3-fund thread.

Move along folks, nothing to see here. Until that, ahem, unexpected inflation in 2021 and 2022, BND was crushing the TIPS fund.

Over this entire 144 month period, after TIPS had settled into their groove, the two intermediate duration bond funds performed about the same … except the TIPS fund was still more volatile, despite doing a tad better in the big down draft of 2022.

Gonna have to record this second comparison as a tie as well.

Next steps

Of course we could continue in this vein, comparing yet other bond funds; but that rather misses the point. The guiding theme of the thread is the hoary old nostrum beloved of the forum: “Take your risk on the equity side. You decide how much risk you can stand, and then you slot in an allocation to BND sufficient to dial back your stock risk to the desired level.”

For that, we need to look at portfolios that hold both stocks and bonds, and see what happens when we swap out BND for some other kind of bond fund.

Results will partly depend on a familiar metric not yet introduced.

Statistics: Posted by McQ — Mon Feb 12, 2024 10:36 pm — Replies 2 — Views 252