For those who want low volatility during retirement, a 30% equity seemed like a good candidate. However with 70% fixed income, the bond fund you select has a sizable influence on the return. Because people who want 30% equity are afraid of volatility, I assume that they want their bond to be as safe as possible. Because shorter duration bonds have lower long term return than longer duration, is there a danger of going too low?

Before we start, I am going to suggest we restrict discussion to a standard stock and bond portfolio that you rebalance each year. Often with this discussion, someone will suggest that you just create a bond ladder to cover each year of expense, essentially converting the fixed income to a income stream. I feel that if you construct your portfolio in this manner, you wouldn't have this question.

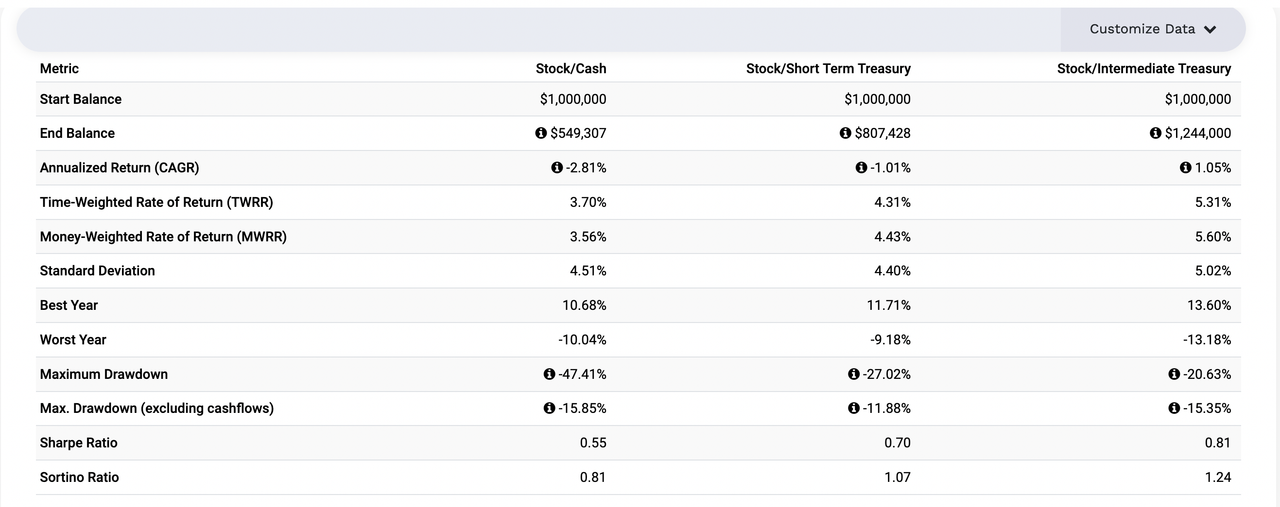

The biggest problem for a high fixed income portfolio may be when interest rate is low. To look for a bad scenario. I look at history at https://pages.stern.nyu.edu/~adamodar/N ... retSP.html, interest rate dropped right around the beginning of 1930's and remain low for about 30 years. However, Portfolio visualizer don't have data for that time period. Another period appears to around 2002 where interest rate dropped and then trended up at around 2022. Let's say we run a portfolio during this time period with a 4% withdraw. This period includes one of the worse bond market in history in 2022 LINK

![Image]()

Due to inflation, a stock/cash portfolio has a real return of -5.81%. A stock/short treasury has a real return of -3.43%. A stock/intermediate treasury had a real return of -1.42%. Even with the stock market crash, the intermediate bond came out ahead. At the end of the period a $1M portfolio of stock/cash has a real portfolio value of $327K, A stock/short term treasury has a real portfolio value of $480K. A stock/Intermediate Treasury has a real portfollo of $740K

I did not include longer duration bond because if you are using a 30% equity, you probably don't want to deal with the high volatility of a long treasury. However, I am wondering if you also feel that it would not be a good idea to have too loow of a duration for a low equity/high fixed income portfolio?

Before we start, I am going to suggest we restrict discussion to a standard stock and bond portfolio that you rebalance each year. Often with this discussion, someone will suggest that you just create a bond ladder to cover each year of expense, essentially converting the fixed income to a income stream. I feel that if you construct your portfolio in this manner, you wouldn't have this question.

The biggest problem for a high fixed income portfolio may be when interest rate is low. To look for a bad scenario. I look at history at https://pages.stern.nyu.edu/~adamodar/N ... retSP.html, interest rate dropped right around the beginning of 1930's and remain low for about 30 years. However, Portfolio visualizer don't have data for that time period. Another period appears to around 2002 where interest rate dropped and then trended up at around 2022. Let's say we run a portfolio during this time period with a 4% withdraw. This period includes one of the worse bond market in history in 2022 LINK

Due to inflation, a stock/cash portfolio has a real return of -5.81%. A stock/short treasury has a real return of -3.43%. A stock/intermediate treasury had a real return of -1.42%. Even with the stock market crash, the intermediate bond came out ahead. At the end of the period a $1M portfolio of stock/cash has a real portfolio value of $327K, A stock/short term treasury has a real portfolio value of $480K. A stock/Intermediate Treasury has a real portfollo of $740K

I did not include longer duration bond because if you are using a 30% equity, you probably don't want to deal with the high volatility of a long treasury. However, I am wondering if you also feel that it would not be a good idea to have too loow of a duration for a low equity/high fixed income portfolio?

Statistics: Posted by gavinsiu — Sun Sep 15, 2024 1:49 pm — Replies 2 — Views 162