I’ve had good experiences at Bogleheads sharing papers I’ve written and getting feedback.

At other times I like to reverse the sequence and get feedback from the forum on a key finding before writing the paper. This is one of those.

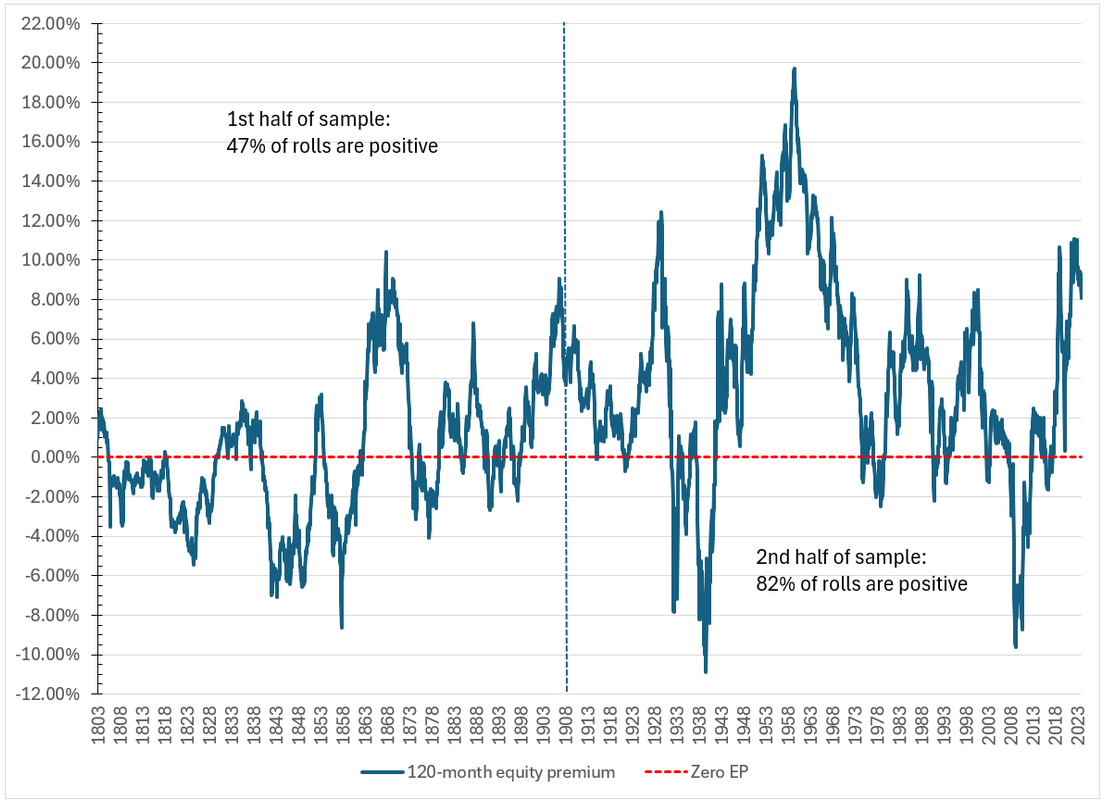

-I’ve constructed new monthly indexes of the real total return on stocks and bonds beginning January 1793, based on 2,771 observations through December 2023.

-The new series uses government bonds only, typically long bonds with a maturity near 20 years.

-Stock returns are Cowles after 1897 and CRSP after 1925; bond returns are from the SBBI after 1925; all earlier returns, in either series, are my compilation.

-Inflation is the Warren-Pearson index before 1913 and the CPI-U thereafter, both applied monthly.

From the monthly returns I compute the annualized real return on the trailing 120 months, stepping forward one month at a time. I subtract the bond return from the stock return and call that value the realized or historical equity premium (some people prefer the term “excess return”).

Here is the chart, presented without further comment—since I am more interested in your reactions than what I think.

![Image]()

Thoughts?

At other times I like to reverse the sequence and get feedback from the forum on a key finding before writing the paper. This is one of those.

-I’ve constructed new monthly indexes of the real total return on stocks and bonds beginning January 1793, based on 2,771 observations through December 2023.

-The new series uses government bonds only, typically long bonds with a maturity near 20 years.

-Stock returns are Cowles after 1897 and CRSP after 1925; bond returns are from the SBBI after 1925; all earlier returns, in either series, are my compilation.

-Inflation is the Warren-Pearson index before 1913 and the CPI-U thereafter, both applied monthly.

From the monthly returns I compute the annualized real return on the trailing 120 months, stepping forward one month at a time. I subtract the bond return from the stock return and call that value the realized or historical equity premium (some people prefer the term “excess return”).

Here is the chart, presented without further comment—since I am more interested in your reactions than what I think.

Thoughts?

Statistics: Posted by McQ — Sun Jul 21, 2024 9:46 pm — Replies 2 — Views 504