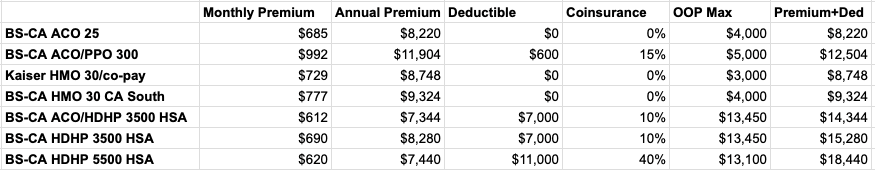

I am currently evaluating different health insurance plans for my family (myself + 2 dependents). Looking at my employer-sponsored plans, all plans are free for me but I pay full price for my dependents. This brings me to the table below:

![Image]()

My family's average health costs from the last 3 years is $18,000. From the 3 HSA accounts offered to me, I will be hitting the OOP maximum every time. Then the question becomes is it worth it to simply have an HSA account with no employer contribution?

I should note that in my previous coverage with an HMO health plan, my total health costs for the year were $7290 for the premium + $600 out of pocket for a total of $7890.

I read this thread: viewtopic.php?t=433001 by @barnaby444 where the numbers drastically differ. In that case, it is indeed significantly advantageous to go with the HDHP plan.

I would appreciate help in thinking through this problem.

My family's average health costs from the last 3 years is $18,000. From the 3 HSA accounts offered to me, I will be hitting the OOP maximum every time. Then the question becomes is it worth it to simply have an HSA account with no employer contribution?

I should note that in my previous coverage with an HMO health plan, my total health costs for the year were $7290 for the premium + $600 out of pocket for a total of $7890.

I read this thread: viewtopic.php?t=433001 by @barnaby444 where the numbers drastically differ. In that case, it is indeed significantly advantageous to go with the HDHP plan.

I would appreciate help in thinking through this problem.

Statistics: Posted by othrif — Wed Jun 26, 2024 10:05 pm — Replies 6 — Views 305