*targeted at a younger crowd, early 70s like me.

Imagine a friend has asked you to look at sales material for a “Single Premium Life Annuity.” There you read:

“This product guarantees to pay out less real money each year for as long as you live, with breathtaking reductions in real income to be expected if you live a very long time.”

Hmmm…not much of a sales pitch. Then you note this fine print at the bottom of the page:

“Payments stop immediately as soon as you die, no matter how soon that happens. You may, however, guarantee payments for a term of 10 years if you will accept a reduced payment for life."

You are at the point of advising your friend to run, not walk away, with a link to the 3-fund thread here on the forum, and the thread on TPAW, to buck him up against the worries about running out of money that drove him to consider an SPIA in the first place.

But then you remember that SPIAs are a frequent topic of discussion on the forum; are, in fact, the only form of life annuity that appears to be acceptable to a substantial fraction of Bogleheads.* Maybe you are missing something?

*MYGAs are also broadly accepted, but these are not life annuities.

After a search and a cursory browse of the links that come up, you learn that Taylor Larimore, the most senior member of the forum, has purchased SPIAs and continues to regard them positively.

You read descriptions of the SPIA that on their face, sound rather more positive.

1.Income you cannot outlive.

2.The only financial product that guarantees income for life.

3.Unlike a sustainable withdrawal rate (SWR) calculation that fails if markets experience a new worst case outcome, the SPIA can never fail to sustain income, as long as the insurance company that guarantees it never fails.

[oops; on second reading that last one wasn’t so reassuring].

4.With an SPIA you earn mortality credits. You can’t simulate mortality credits on your own; these require a large pool of purchasers, some of whom experience mortality debits which fund the credits granted others.

[sounds intriguing, except for that worrisome mention of “mortality debits.”]

You decide to sleep on it before getting back to your friend. Maybe the SPIA is worth a second look.

Eureka!

On waking you realize that both the positive and negative characterizations of the SPIA are correct. These are easily integrated by constructing two new statements, the first of which never appears in sales literature, because false, and the second of which seldom appears on the forum, because discomfiting.

1.FALSE: This product guarantees a set level of real income no matter how long you live,

Or

2.DISCOMFITING: This product is guaranteed for life only; if you die young, a substantial fraction of the wealth you expended on its purchase will be forfeited and distributed to those who outlive you.

The first statement is false here in the US; such products are no longer offered. That’s one reason a profit-seeking insurance company can promise “income for life” and make a business so doing. Their fingers are crossed behind their back; as you look away, they mouth “nominal.” Money illusion then makes the sale.

The second statement is discomfiting; it makes clear the meaning of “mortality debit.” You, as a resident of Lake Wobegon, know that you will experience above-average longevity, which will be funded by those tasty-sounding mortality credits, so that the SPIA payments will continue even as you reach age 95, age 100, age 105, age 110 … Yowza!

Wait a minute. You are a rational adult with decades of experience on the receiving end of sales pitches. How is this “income for life,” even to age 110 and beyond, even possible?

“I dunno, something about mortality credits?”

More exactly, the combination of mortality DEBITS with mortality credits makes it feasible for the insurance company to promise EVERY purchaser of an SPIA that yes, payments will continue for life, even to age 110, or beyond, if indeed they prove to be long-lived.

The promise is feasible because not every purchaser of an SPIA lives in Lake Wobegon. Some purchasers are going to die young. In fact, LOTS of purchasers must die young, and forfeit wealth relative to what they could have earned absent the SPIA purchase, for other purchasers to continue receiving payments beyond the average life span.

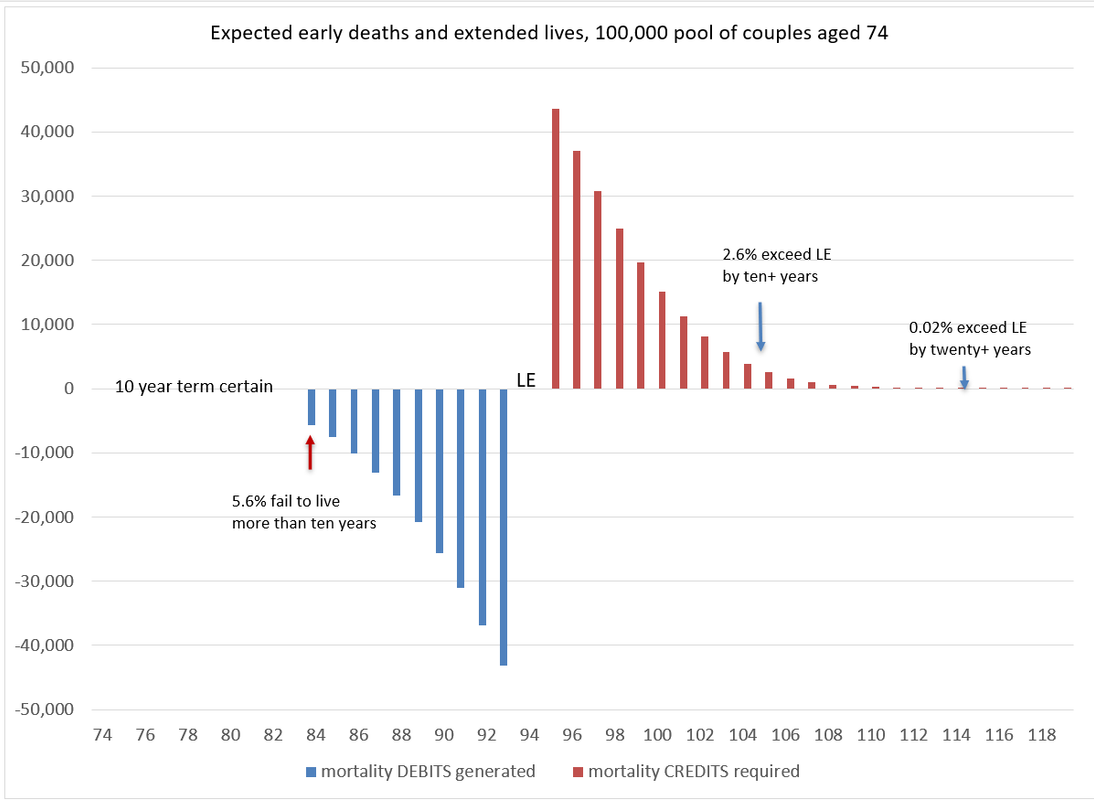

Here’s how it looks, in terms of death years and life years, based on IRS mortality tables (“annuitant mortality”), with a ten-year guarantee (=no mortality debits for the first ten years, everyone gets paid).

![Image]()

*Life expectancy of 20 years, to 94

If you focus on the red bars, you will immediately grasp the appeal of an SPIA: there is a substantial risk of “excess life” even when the SPIA is taken out at age 74, an age that many would consider, ah, already aged. Some 44% can expect to have one member of the couple outlive life expectancy (94) by one year. About 15% will produce a centenarian; 2.6% will survive more than ten years past LE; and there are projected to be three couples one member of whom will survive to age 119.*

*I should acknowledge that counts past age 100 are more model-based than data-based, here in 2024—those projections pertain to mortality outcomes not measurable until 2050 and later.

If your eye happens to fall first on the blue bars, you may be brought up short: about 43% will fail to live to life expectancy, with both dead before 94; just over 25% will see neither member make it to 90; and 5.6% won’t make it one year past the term certain.

Do you need to insure against excess life? If you live in Lake Wobegon, it is probably a good idea—those red bars stretch w-a-a-y out to the right. If you consider yourself to be utterly normal, nothing special in terms of health or family situation, then you have to accept that the SPIA is a wager. There is a 43% chance that you would die with more wealth if you do NOT purchase the SPIA and instead dole out the annuity payment annually from an investment in bonds.

But of course, there is a 44% chance that the bond investment will have run down to zero for at least one year; and a 2.6% chance that without the SPIA, you will run out of money ten years before you run out of life. Ouch.

Summary

The insurance company functions as an agent for the pool of annuitants, and custodian of their funds, investing safely in a diversified pool of fixed income securities, collecting forfeited wealth from those who die young, stockpiling it, and then metering it out to those who outlive expectations, charging a fee for these services of course.*

*There is a time-value-of-money element that I have excluded for simplicity; see Exhibit 4.1 on p. 110 of Wade Pfau's book, Safety-First Retirement Planning, for an accessible illustration of the power of double-discounting liabilities in the distant future.

If the firm employs competent actuaries (“mortality statisticians”) and the pool is large enough, the laws of probability guarantee that mortality debits and credits will net out and the insurance company, backed by reserves set aside to cover the occasional freakish event (e.g., too many people in a particular pool living past 100), will be able to fulfill the promise of income for life for any who continue to live.

Because nobody lives forever.

Conclusion

1.You can guarantee income for life if you are willing to wager your longevity against that of other purchasers;

2.And if you will be content with nominal income.

Next steps

The SPIA would appear to be a product that cries out for a hedge. One hedge is already in place: very few SPIAs are sold without some kind of term certain guarantee. For married couples in the early 70s, with joint life expectancy of 20+ years, a 10-year guarantee reduces the payment by only about 1%. Try it on immediateannuities.com: enter a male and female age 74 in California, income starting next month; on Sunday May 26th, $125,000 produced monthly income of $828 life-only, and $821 for life plus 10 years certain.

That means no mortality debits for death in the first ten years. At the rates quoted, just under 80% of the premium would have been paid out if both were to die at ten years and a day, limiting the amount of wealth forfeiture; except, if inflation averaged 3% over that span, the amount paid would only be about 60% of the nominal wealth you could have had from investing the annuity premium into iBonds paying a 0% rate on top of 3% inflation and left untouched for ten years.

Could a TIPS ladder hedge the other shortcoming of an SPIA, the loss of real income? Look for a future thread.

Imagine a friend has asked you to look at sales material for a “Single Premium Life Annuity.” There you read:

“This product guarantees to pay out less real money each year for as long as you live, with breathtaking reductions in real income to be expected if you live a very long time.”

Hmmm…not much of a sales pitch. Then you note this fine print at the bottom of the page:

“Payments stop immediately as soon as you die, no matter how soon that happens. You may, however, guarantee payments for a term of 10 years if you will accept a reduced payment for life."

You are at the point of advising your friend to run, not walk away, with a link to the 3-fund thread here on the forum, and the thread on TPAW, to buck him up against the worries about running out of money that drove him to consider an SPIA in the first place.

But then you remember that SPIAs are a frequent topic of discussion on the forum; are, in fact, the only form of life annuity that appears to be acceptable to a substantial fraction of Bogleheads.* Maybe you are missing something?

*MYGAs are also broadly accepted, but these are not life annuities.

After a search and a cursory browse of the links that come up, you learn that Taylor Larimore, the most senior member of the forum, has purchased SPIAs and continues to regard them positively.

You read descriptions of the SPIA that on their face, sound rather more positive.

1.Income you cannot outlive.

2.The only financial product that guarantees income for life.

3.Unlike a sustainable withdrawal rate (SWR) calculation that fails if markets experience a new worst case outcome, the SPIA can never fail to sustain income, as long as the insurance company that guarantees it never fails.

[oops; on second reading that last one wasn’t so reassuring].

4.With an SPIA you earn mortality credits. You can’t simulate mortality credits on your own; these require a large pool of purchasers, some of whom experience mortality debits which fund the credits granted others.

[sounds intriguing, except for that worrisome mention of “mortality debits.”]

You decide to sleep on it before getting back to your friend. Maybe the SPIA is worth a second look.

Eureka!

On waking you realize that both the positive and negative characterizations of the SPIA are correct. These are easily integrated by constructing two new statements, the first of which never appears in sales literature, because false, and the second of which seldom appears on the forum, because discomfiting.

1.FALSE: This product guarantees a set level of real income no matter how long you live,

Or

2.DISCOMFITING: This product is guaranteed for life only; if you die young, a substantial fraction of the wealth you expended on its purchase will be forfeited and distributed to those who outlive you.

The first statement is false here in the US; such products are no longer offered. That’s one reason a profit-seeking insurance company can promise “income for life” and make a business so doing. Their fingers are crossed behind their back; as you look away, they mouth “nominal.” Money illusion then makes the sale.

The second statement is discomfiting; it makes clear the meaning of “mortality debit.” You, as a resident of Lake Wobegon, know that you will experience above-average longevity, which will be funded by those tasty-sounding mortality credits, so that the SPIA payments will continue even as you reach age 95, age 100, age 105, age 110 … Yowza!

Wait a minute. You are a rational adult with decades of experience on the receiving end of sales pitches. How is this “income for life,” even to age 110 and beyond, even possible?

“I dunno, something about mortality credits?”

More exactly, the combination of mortality DEBITS with mortality credits makes it feasible for the insurance company to promise EVERY purchaser of an SPIA that yes, payments will continue for life, even to age 110, or beyond, if indeed they prove to be long-lived.

The promise is feasible because not every purchaser of an SPIA lives in Lake Wobegon. Some purchasers are going to die young. In fact, LOTS of purchasers must die young, and forfeit wealth relative to what they could have earned absent the SPIA purchase, for other purchasers to continue receiving payments beyond the average life span.

Here’s how it looks, in terms of death years and life years, based on IRS mortality tables (“annuitant mortality”), with a ten-year guarantee (=no mortality debits for the first ten years, everyone gets paid).

*Life expectancy of 20 years, to 94

If you focus on the red bars, you will immediately grasp the appeal of an SPIA: there is a substantial risk of “excess life” even when the SPIA is taken out at age 74, an age that many would consider, ah, already aged. Some 44% can expect to have one member of the couple outlive life expectancy (94) by one year. About 15% will produce a centenarian; 2.6% will survive more than ten years past LE; and there are projected to be three couples one member of whom will survive to age 119.*

*I should acknowledge that counts past age 100 are more model-based than data-based, here in 2024—those projections pertain to mortality outcomes not measurable until 2050 and later.

If your eye happens to fall first on the blue bars, you may be brought up short: about 43% will fail to live to life expectancy, with both dead before 94; just over 25% will see neither member make it to 90; and 5.6% won’t make it one year past the term certain.

Do you need to insure against excess life? If you live in Lake Wobegon, it is probably a good idea—those red bars stretch w-a-a-y out to the right. If you consider yourself to be utterly normal, nothing special in terms of health or family situation, then you have to accept that the SPIA is a wager. There is a 43% chance that you would die with more wealth if you do NOT purchase the SPIA and instead dole out the annuity payment annually from an investment in bonds.

But of course, there is a 44% chance that the bond investment will have run down to zero for at least one year; and a 2.6% chance that without the SPIA, you will run out of money ten years before you run out of life. Ouch.

Summary

The insurance company functions as an agent for the pool of annuitants, and custodian of their funds, investing safely in a diversified pool of fixed income securities, collecting forfeited wealth from those who die young, stockpiling it, and then metering it out to those who outlive expectations, charging a fee for these services of course.*

*There is a time-value-of-money element that I have excluded for simplicity; see Exhibit 4.1 on p. 110 of Wade Pfau's book, Safety-First Retirement Planning, for an accessible illustration of the power of double-discounting liabilities in the distant future.

If the firm employs competent actuaries (“mortality statisticians”) and the pool is large enough, the laws of probability guarantee that mortality debits and credits will net out and the insurance company, backed by reserves set aside to cover the occasional freakish event (e.g., too many people in a particular pool living past 100), will be able to fulfill the promise of income for life for any who continue to live.

Because nobody lives forever.

Conclusion

1.You can guarantee income for life if you are willing to wager your longevity against that of other purchasers;

2.And if you will be content with nominal income.

Next steps

The SPIA would appear to be a product that cries out for a hedge. One hedge is already in place: very few SPIAs are sold without some kind of term certain guarantee. For married couples in the early 70s, with joint life expectancy of 20+ years, a 10-year guarantee reduces the payment by only about 1%. Try it on immediateannuities.com: enter a male and female age 74 in California, income starting next month; on Sunday May 26th, $125,000 produced monthly income of $828 life-only, and $821 for life plus 10 years certain.

That means no mortality debits for death in the first ten years. At the rates quoted, just under 80% of the premium would have been paid out if both were to die at ten years and a day, limiting the amount of wealth forfeiture; except, if inflation averaged 3% over that span, the amount paid would only be about 60% of the nominal wealth you could have had from investing the annuity premium into iBonds paying a 0% rate on top of 3% inflation and left untouched for ten years.

Could a TIPS ladder hedge the other shortcoming of an SPIA, the loss of real income? Look for a future thread.

Statistics: Posted by McQ — Mon May 27, 2024 4:52 pm — Replies 3 — Views 329