Hi Bogleheads,

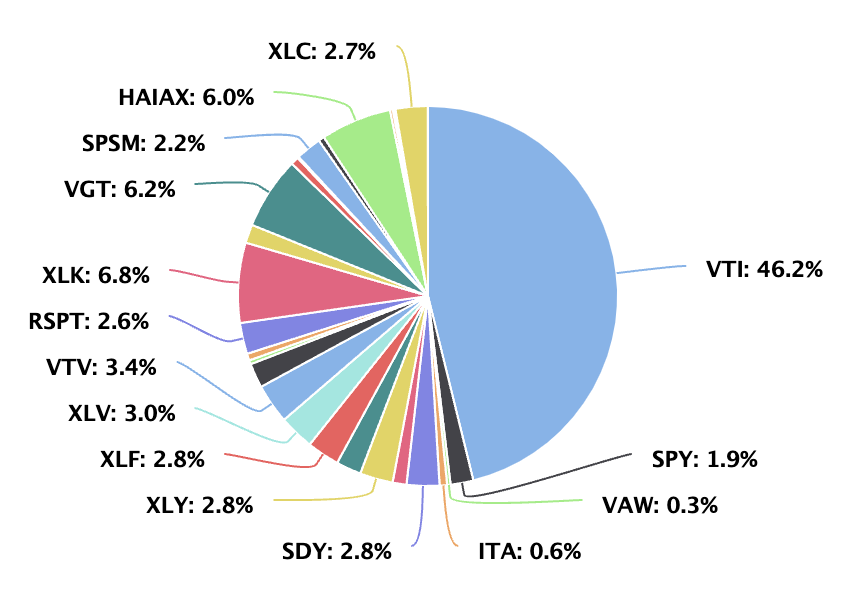

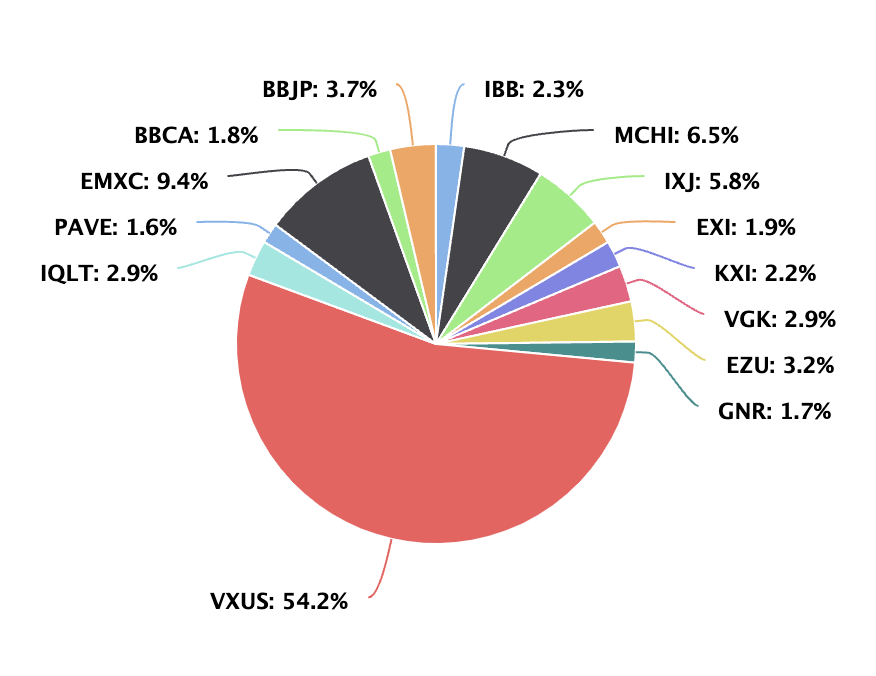

I'm trying to invest using a boring 3-fund portfolio, with VTI and VXUS for stocks. I've also inherited a managed portfolio, which was composed of 40(!) ETFs and other weird stuff. I'm in the process of moving out of Merril to a brokerage account, but then I'll have a strange mix of VTI + 25 other things, and VXU + 16 other things. I don't have any accounts which are tax friendly (long story), so rebalancing can be a tax hit. In the following figures, I've shown how the US and ex-US portfolios would look, respectively. My question is whether to mentally just consider all the US stuff like some weird "VTI" and the other stuff a weird "VXUS", rebalance over time, rebalance only some things, etc. I'm not sure even what to ask exactly (so please LMK what information would be relevant). Many thanks!

![Image]()

![Image]()

I'm trying to invest using a boring 3-fund portfolio, with VTI and VXUS for stocks. I've also inherited a managed portfolio, which was composed of 40(!) ETFs and other weird stuff. I'm in the process of moving out of Merril to a brokerage account, but then I'll have a strange mix of VTI + 25 other things, and VXU + 16 other things. I don't have any accounts which are tax friendly (long story), so rebalancing can be a tax hit. In the following figures, I've shown how the US and ex-US portfolios would look, respectively. My question is whether to mentally just consider all the US stuff like some weird "VTI" and the other stuff a weird "VXUS", rebalance over time, rebalance only some things, etc. I'm not sure even what to ask exactly (so please LMK what information would be relevant). Many thanks!

Statistics: Posted by monkeytoad — Sun Apr 21, 2024 1:49 pm — Replies 5 — Views 332