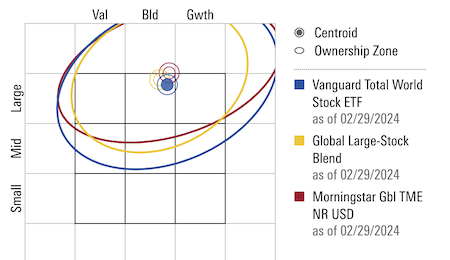

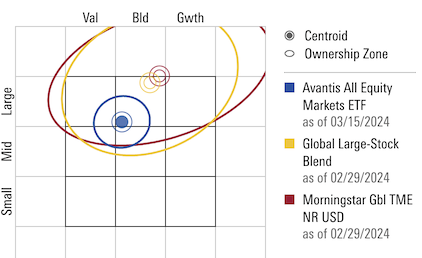

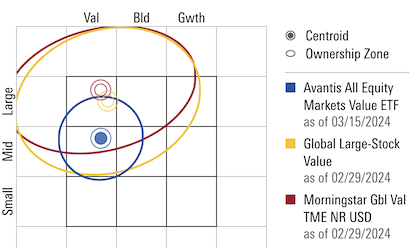

I think it's interesting to compare these three funds

VT - Vanguard Total World Stock

AVGE - Avantis All Equity Markets

AVGV - Avantis All Equity Markets Value

previous threads: AVGE, AVGV and others

Optimized Portfolio AVGV review: https://www.youtube.com/watch?v=4_U77heiMt8

Interesting things I see:

- VT and AVGE are different in regions - AVGE intentionally has a US bias

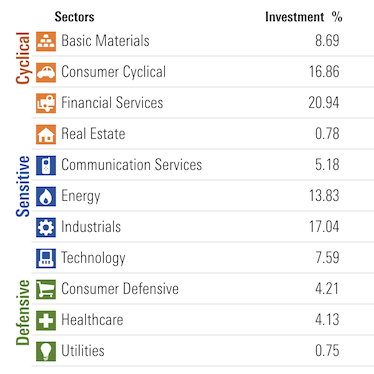

- VT and AVGV are very very close in regions, which is reassuring to me that AVGV is implementing a size and value thesis without a lot of other opinions.

- AVGE has more real estate than VT. I thought maybe this was a consequence of the US-tilt, but looking at VTSAX vs VTIAX, international actually has a little more real estate, so maybe this is some sort of opinion of Avantis, or a consequence of the small value tilt (I guess this makes sense - a lot less magnificent 7 will result in more real estate). it does include AVRE, the Avantis real estate fund.

- AVGV has much less real estate. it does _not_ include AVRE, so any real estate exposure comes "incidentally" from other things.

The impetuous for my comparison: I'm interested in being heavily in AVGV but wanted to make sure that it isn't "missing something" (e.g. you could maybe compose a portfolio with small cap and midcap value funds that had a deceptively similar style box, but end up with no exposure to large cap growth). My conclusion to this question is that the only thing it is missing is real estate.

It's interesting that, compared to VT, each of AVGE and AVGV have an "opinion", different form one another.

AVGE

style: light small value tilt

opinion: US bias

AVGV

style: moderate small value tilt

opinion: no real estate

STYLE

VT

![Image]()

AVGE

![Image]()

AVGV

![Image]()

REGIONS

VT

![Image]()

AVGE

![Image]()

AVGV

![Image]()

SECTORS

VT

![Image]()

AVGE

![Image]()

AVGV

![Image]()

VT - Vanguard Total World Stock

AVGE - Avantis All Equity Markets

AVGV - Avantis All Equity Markets Value

previous threads: AVGE, AVGV and others

Optimized Portfolio AVGV review: https://www.youtube.com/watch?v=4_U77heiMt8

Interesting things I see:

- VT and AVGE are different in regions - AVGE intentionally has a US bias

- VT and AVGV are very very close in regions, which is reassuring to me that AVGV is implementing a size and value thesis without a lot of other opinions.

- AVGE has more real estate than VT. I thought maybe this was a consequence of the US-tilt, but looking at VTSAX vs VTIAX, international actually has a little more real estate, so maybe this is some sort of opinion of Avantis, or a consequence of the small value tilt (I guess this makes sense - a lot less magnificent 7 will result in more real estate). it does include AVRE, the Avantis real estate fund.

- AVGV has much less real estate. it does _not_ include AVRE, so any real estate exposure comes "incidentally" from other things.

The impetuous for my comparison: I'm interested in being heavily in AVGV but wanted to make sure that it isn't "missing something" (e.g. you could maybe compose a portfolio with small cap and midcap value funds that had a deceptively similar style box, but end up with no exposure to large cap growth). My conclusion to this question is that the only thing it is missing is real estate.

It's interesting that, compared to VT, each of AVGE and AVGV have an "opinion", different form one another.

AVGE

style: light small value tilt

opinion: US bias

AVGV

style: moderate small value tilt

opinion: no real estate

STYLE

VT

AVGE

AVGV

REGIONS

VT

AVGE

AVGV

SECTORS

VT

AVGE

AVGV

Statistics: Posted by cat_guy — Sun Mar 17, 2024 1:14 am — Replies 2 — Views 353