Hi, I am doing calculations for contributions to a solo 401(k) for the first time. While I followed the rules for these calculations, I am still not sure if I did them correctly or if I am missing anything. I have a Qualified Joint Venture (QJV) with my spouse, and I also have a full-time job with a 401(k) there. Our goal is to maximize contributions to the solo traditional 401(k) and make mega-backdoor Roth contributions for the rest of the funds.

Contributions to 401k from my full time W2 job are the following:

Employee Contributions: $21,531.52 (aggregated across retirement plans)

Employer Contributions: $8,074.32 (does not aggregated across retirement plans)

Spouse does not have W2 job but materially participate in QJV.

QJV income (before any taxes) for me and my spouse: $167,462

QJV income for each of us: $167,462 / 2 = $83,731.00

Earnings subject to self-employment tax: $83,731 * 0.9235 = $77,325.58

One-half of the self-employment tax: $77,325.58 * 0.0765 = $5,915.41

Net earnings from QJV income: $83,731.00 - $5,915.41 = $77,815.59

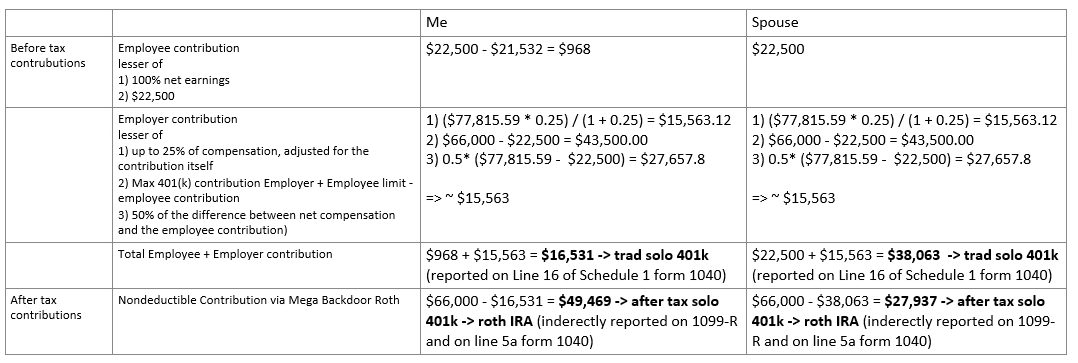

And here are calculations for contributions:

![Image]()

Are those look correct? Do I miss something? Thank you in advance for any help.

Contributions to 401k from my full time W2 job are the following:

Employee Contributions: $21,531.52 (aggregated across retirement plans)

Employer Contributions: $8,074.32 (does not aggregated across retirement plans)

Spouse does not have W2 job but materially participate in QJV.

QJV income (before any taxes) for me and my spouse: $167,462

QJV income for each of us: $167,462 / 2 = $83,731.00

Earnings subject to self-employment tax: $83,731 * 0.9235 = $77,325.58

One-half of the self-employment tax: $77,325.58 * 0.0765 = $5,915.41

Net earnings from QJV income: $83,731.00 - $5,915.41 = $77,815.59

And here are calculations for contributions:

Are those look correct? Do I miss something? Thank you in advance for any help.

Statistics: Posted by ill — Mon Feb 26, 2024 12:52 am — Replies 1 — Views 147